Fraud alerts: Protect your identity and finances

Fraud prevention alerts

Keep your identity and bank accounts safe by responding to alerts on your phone.

Enhanced security

If we detect unusual activity, such as suspicious transactions or logins to our mobile and online services, we'll send you a push notification or text message to verify it's you. Text alerts will come from these short codes:

- 337501

- 337502

- 337503

- 337504

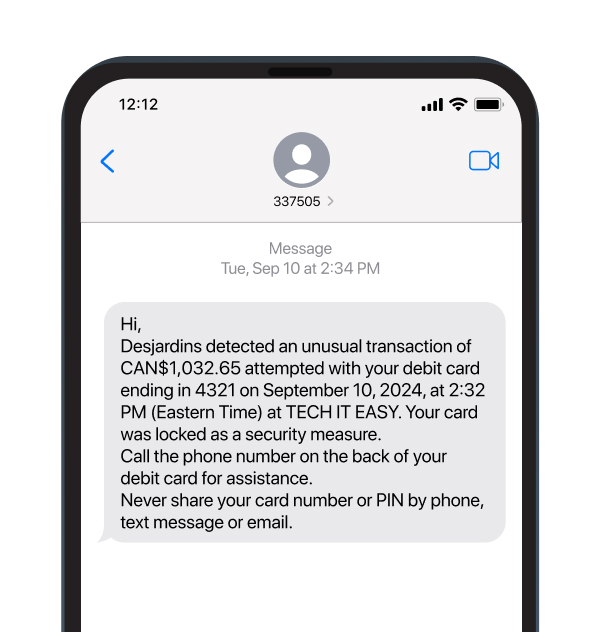

- 337505

Benefits

Free

This fraud prevention service is free for all our members and clients.

Simple

Simply reply to confirm whether it was you. That's it!

Secure

These alerts help protect you from identity theft and fraud.

How to get security alerts

Credit card alerts

If we detect any unusual activity on your credit card, we'll send you an instant notification in the Desjardins mobile app or a text message to verify it's you.

Push notifications

To be notified of suspicious transactions on your credit card, turn on push notifications in our mobile app.

- Log in to the Desjardins mobile services app.

- Select More, then Security.

- Select Devices.

- In the Is this your device? section, answer Yes if the device belongs to you.

- Select More, then Back.

- Select More, then Profile and settings.

- Select Notifications, then Enable to receive them.

Make sure notifications are enabled in your device settings as well.

Text messages

To get alerts by text message, you need to have a cellphone number on file.

In the app

- Log in to the Desjardins mobile services app.

- Select More, then MoreMore.

- Select Contact information.

- Under Phone and email, select Edit.

- Add or change your cellphone number and select OK.

- Make sure the information is correct and select Confirm.

In a browser

- Log in to AccèsD.

- Select Profile and preferences.

- Under Profile, select Change contact information.

- Under Phone and email, select Edit.

- Add or change your cellphone number and select OK.

- Make sure the information is correct and select Confirm.

Sample text message

Hi ROBIN GRIFFIN,

Desjardins detected an unusual transaction of CAN$195.73 attempted with your Visa ending in 4561 on April 11, 2024, at 2:32 PM (Eastern Time) at MAJESTIC JEWELLERS. Your card has been locked as a security measure.

Was this you? Reply Yes or No, then try your transaction again if necessary.

Confirm if you recognize the transaction

- If you made the transaction, reply Yes.

- If you didn't make the transaction, reply No and call us at 1-866-335-0338, option 2.

Debit card alerts

If we detect unusual activity on your debit card, we'll block the card and notify you by text message. For help, call the number on the back of your card.

Text messages

To get alerts by text message, you need to have a cellphone number on file.

In the app

- Log in to the Desjardins mobile services app.

- Select More, then Profile and settings.

- Select Contact information.

- Under Phone and email, select Edit.

- Add or change your cellphone number and select OK.

- Make sure the information is correct and select Confirm.

In a browser

- Log in to AccèsD.

- Select Profile and preferences.

- Under Profile, select Change contact information.

- Under Phone and email, select Edit.

- Add or change your cellphone number and select OK.

- Make sure the information is correct and select Confirm.

Sample text message

Hi,

Desjardins detected an unusual transaction of CAN$1,032.65 attempted with your debit card ending in 4321 on September 10, 2024, at 2:32 PM (Eastern Time) at TECH IT EASY. Your card was locked as a security measure.

Call the phone number on the back of your debit card for assistance.

Never share your card number or PIN by phone, text message or email.

Alerts for mobile and online services

Push notifications

You need to enable push notifications on your device so we can notify you of any suspicious activity in our mobile and online services, including unusual transactions or logins.

- Log in to the Desjardins mobile services app.

- Select More, then Security.

- Select Devices.

- In the Is this your device? section, answer Yes if the device belongs to you.

- Select More, then Back.

- Select More, then Profile and preferences.

- Select Notifications, then Enable to receive them.

Make sure notifications are enabled in your device settings as well.

Text messages

We'll send you a text message if we detect unusual activity in our mobile and online services, such as a suspicious login. To receive text messages, you need to have a cellphone number on file.

In the app

- Log in to the Desjardins mobile services app.

- Select More, then Security.

- Select Identity verification and alerts.

- Under Phone number, select Add or Edit.

- Enter the number, then select Continue.

- You'll receive a verification code by text message to confirm your phone number.

- Enter the code, then select Continue.

In a browser

- Log in to AccèsD.

- Select Security.

- Select Identity verification and alerts.

- Under Phone number, select Add or Edit.

- Enter the number, then select Continue.

- You'll receive a verification code by text message to confirm your phone number.

- Enter the code, then select Continue.

If we detect unusual activity in our mobile and online services, like a password change, we'll send you an email. To get security alerts by email, you need to have an email address on file.

In the app

- Log in to the Desjardins mobile services app.

- Select More, then Security.

- Select Identity verification and alerts.

- Under Email address, select Add or Edit.

- Enter the email address, then select Continue.

- You'll receive a verification code by email to confirm your address.

- Enter the code, then select Continue.

In a browser

- Log in to AccèsD.

- Select Security.

- Select Identity verification and alerts.

- Under Email address, select Add or Edit.

- Enter the email address, then select Continue.

- You'll receive a verification code by email to confirm your address.

- Enter the code, then select Continue.

Confirm or deny the login

- If it was you who logged in, reply Yes and continue using AccèsD.

- If you did not log in, reply No and call us at 1-866-335-0338. Your AccèsD session will be temporarily deactivated as a precaution.

Recognizing and avoiding fraud

Protect your personal and financial information

Pay special attention to messages that look like they're from your financial institution. Scammers copy legitimate messages in an attempt to get your personal or banking information.

We'll never send you a security alert asking you to click a link to log in toAccèsDor to send us your personal information.

Protect your account

It's your responsibility to let us know right away if there's an issue with your card (such as loss or theft). You are responsible for all transactions on your account, even those made by someone you've authorized. If you notice an error, contact us within 30 days of receiving your statement.

Extra security with 2-step verification

Protect your account from unauthorized access and turn on 2-step verification on our mobile and online services for added security.

More resources

Security in our mobile and online services

In the mobile app, select More, then Security. In a browser, open the AccèsD home page, then select Security to get personalized recommendations and tips on how to keep your account as secure as possible.

Phishing

Learn to spot phishing attempts and what to do about them. These scams are on the rise, but you can stay safe by knowing how to avoid them.

Desjardins Identity Protection

We offer protection to safeguard your assets and support you if your identity is stolen.

Staying secure

Discover our security measures and what you can do to protect yourself.

FAQ – Security alerts

- Some conditions apply. For more information, including your obligations, please refer to the Desjardins Debit Card Terms of Use (PDF, 146 KB) and the terms and conditions of your account opening contract.