Timeline

"Humble beginnings are not an obstacle to future greatness."

Alphonse Desjardins, "Les caisses d'épargne et de crédit populaire" in La Vérité, December 15, 1906

Discover the birthplace of cooperation in this 15-minute video - This link will open in a new window. and learn about the origins of the very first cooperative group in North America. This video visit will offer you an in-depth look at the lives of Alphonse and Dorimène Desjardins, founders of Desjardins Group. Delve into their history, and witness it as though you were there.

1844: The pioneers of the cooperative movement

In December, 28 British weavers found the first cooperative: the Rochdale Society of Equitable Pioneers.

Some of the Rochdale pioneers (The Co-operative College of Manchester)

Some of the Rochdale pioneers (The Co-operative College of Manchester) The 28 weavers who founded the small cooperative store in Rochdale near Manchester, England, are considered the pioneers of the worldwide cooperative movement. As for savings and credit cooperatives, or caisses populaires, they first appeared in Europe in the middle of the 19th century. In Germany, Hermann Schulze founded the first cooperative bank in Delitzsch in 1850. He was followed by fellow countryman Friedrich Wilhelm Raiffeisen, who founded a credit cooperative in Heddesdorf in 1864. The following year, a people's bank opened in Milan, Italy, on the initiative of Luigi Luzzatti.

1854: Birth of Alphonse Desjardins

Born on November 5, 1854, in Lévis, Alphonse Desjardins is the eighth of 15 children.

Alphonse Desjardins at about 24 years of age (CPDL)

Alphonse Desjardins at about 24 years of age (CPDL) Despite his humble beginnings, he completed the bilingual commercial course at Collège de Lévis and received officer training at the Military School of Quebec. He was then a military man, journalist, editor of parliamentary debates in Quebec City, newspaper owner and parliamentary reporter in Ottawa. Deeply involved in the development of his home town, Desjardins became interested early on in social and economic problems. He saw in association a remedy for isolation and society's ills.

1858: Birth of Dorimène Desjardins

Wife and faithful collaborator of Alphonse Desjardins, Dorimène Desjardins is born on September 17, 1858.

Dorimène Desjardins in 1913 (A.G. Pittaway, FCDQ)

Dorimène Desjardins in 1913 (A.G. Pittaway, FCDQ) On September 2, 1879, she married Alphonse Desjardins, with whom she had 10 children. With a gift for management and accounting, Dorimène soon became involved in the daily operations of Caisse populaire de Lévis, founded in December 1900. A prudent manager attuned to the needs of members, she showed great vigilance at the time the caisse head office was housed in the family home. She is known today as the co-founder of Desjardins Group.

1897: International-scale research

At the Ottawa House of Commons, Alphonse Desjardins is scandalized by "tragic testimony" regarding usurious practices widespread in Canada at the time.

The Library of Parliament (BANQ)

The Library of Parliament (BANQ) In his position as French stenographer, Alphonse Desjardins took down the comments of a member who introduced a bill to prevent usury1, citing the example of a citizen sentenced to pay interest charges of $5,000 on an initial loan of $150. A self-taught economist, Desjardins began doing research on an international scale for a solution. In the spring of 1898, he came in contact with the main promoters of cooperative credit in Europe. He then studied the way savings cooperatives worked in North America. His experience abroad showed the effectiveness of the cooperative formula to fight against usury, democratize access to credit and support local development.

1. The practice of lending money at unreasonably high interest rates

After founding a first caisse and obtaining legal recognition for it in 1906, Alphonse Desjardins devoted himself, with the continued support of his wife Dorimène Desjardins and the help of journalists, priests and social stakeholders, to increasing the number of caisses.

1900: Lévis pioneers

The origins of Desjardins Group date back to the founding of Caisse populaire de Lévis on December 6, 1900.

The first officers of the first caisse populaire (FCDQ)

The first officers of the first caisse populaire (FCDQ) It was the first savings and credit cooperative established in North America. The night it was founded, about 100 people from Lévis signed a social pact and approved the cooperative's rules and by-laws. It was a new limited liability and variable capital model, a "unique synthesis" of various European cooperative models, European savings cooperatives, American savings banks and permanent and mutual construction companies. The first 6 years, the Caisse had no legal recognition whatsoever. After a few unsuccessful attempts with the Ottawa parliament, Alphonse Desjardins obtained, in 1906, a legislative framework for cooperatives from the Quebec Legislative Assembly.

1907: The first school caisse

In the fall, Alphonse Desjardins lays down the foundation for the first school caisses to collect the savings of schoolchildren.

Students at the first convention of school caisses supervisors in Saint-Hyacinthe in 1959 (FCDQ)

Students at the first convention of school caisses supervisors in Saint-Hyacinthe in 1959 (FCDQ) From the time the first caisse populaire was founded in Lévis, Alphonse Desjardins planned to establish a special savings service for children. He first tested it in a Lévis school in 1901. In the fall of 1907, he firmly committed to the project and laid down the foundation of a school savings service in the Lévis area. Alphonse Desjardins spared no effort to promote "penny savings", which he considered a means of developing a new generation of savers. Constantly seeking new ways of adapting to social and economic change, school caisse is still, to this day, active in many schools.

1908: Expansion into the United States

In November, 1908, Alphonse Desjardins makes his first of 5 trips to the United States. The founder and his work met with great success there in the years that followed.

Location of the first caisse populaire in the United States (Pierre Goulet, FCDQ)

Location of the first caisse populaire in the United States (Pierre Goulet, FCDQ) While on his first trip, Desjardins set up the country's first savings and credit cooperative in Sainte-Marie de Manchester, New Hampshire, becoming the initiator of the credit union movement in the U.S. In the years that followed, he helped draft the first bills regarding cooperatives in a few states, established 9 caisses, was the subject of newspaper and magazine articles and published a brochure on caisses populaires. In December 1912, Desjardins was invited to Washington by U.S. president William Howard Taft to take part in an American governor's convention on agricultural credit on December 7. He was unfortunately unable to attend.

1912: Foundation of a caisse populaire in Ontario

On March 31, 1912, Alphonse Desjardins founds the Caisse populaire de Sainte-Anne d'Ottawa in Ontario.

A brochure reproducing the text of a lecture given by Alphonse Desjardins in Ontario in 1912 (BANQ)

A brochure reproducing the text of a lecture given by Alphonse Desjardins in Ontario in 1912 (BANQ) The Caisse populaire de Sainte-Anne d'Ottawa is the oldest caisse populaire established by Alphonse Desjardins in Ontario to have stood the test of time. Today, it is part of Caisse populaire Rideau d'Ottawa. The founder had been active in the province for several years. In 1908, he had established the first group caisse in North America, the Civil Service Savings and Loan Society for federal government employees, which still exists under the name Alterna Savings - Caisse Alterna. In 1910 and 1911, he founded, in Ottawa, 2 caisses populaires that closed a few years later. In all, Alphonse Desjardins founded 18 caisses populaires and 1 group caisse in Ontario, as well as giving numerous lectures.

1920: Death of Alphonse Desjardins

At the end of a very full life, Alphonse Desjardins dies in his home in Lévis on October 31, 1920, a few days shy of his 66th birthday.

Alphonse Desjardins in front of his home in 1920 (SHAD)

Alphonse Desjardins in front of his home in 1920 (SHAD) With the help of his wife, journalists, the clergy and social stakeholders, he founded 136 caisses in Quebec, 19 in Ontario and 9 in the U.S. He devoted the last few years of his life to the promotion and development of projects for a federation and central caisse, which he was unable to see through before his death. "The work he left behind makes him the greatest economic leader in Quebec," would write Rodrigue Tremblay in Les Affaires newspaper on September 30, 2000. This claim echoed a statement made in the weekly Toronto newspaper The Farmers' Sun on April 23, 1913, predicting that Alphonse Desjardins would one day be known throughout the world as one of Canada's greatest men.

After Alphonse Desjardins's death, the people who continued his work took over the task of putting in place the organizational structures required for future progress.

1920: Foundation of the first Union régionale

In December, caisses populaires in the Trois-Rivières Diocese organize the first Union régionale, initiating a movement to consolidate caisses into umbrella organizations.

Participants of the 1927 Annual General Meeting of Union régionale de Québec (FCDQ)

Participants of the 1927 Annual General Meeting of Union régionale de Québec (FCDQ) Throughout the 1920's, Unions régionales were established in Quebec City, Montreal and Gaspé. Unions régionales were cooperative organizations whose members were caisses populaires. Their task was to defend the interests of the caisses, provide oversight through regular inspections, promote cooperation and found other caisses. Over time, each Union set up a regional caisse to manage affiliated caisses's excess liquidity and cheque clearing. Unions régionales started off with little or no means, but were essentially the beginning stages of the Desjardins caisse network.

1932: Foundation of the Fédération

Problems stemming from the Great Depression and government pressure give rise to Fédération de Québec des unions régionales de caisses populaires Desjardins.

The Fédération was located in the Price building in Quebec City from 1932 to 1945. (G. DesRosiers, FCDQ)

The Fédération was located in the Price building in Quebec City from 1932 to 1945. (G. DesRosiers, FCDQ) To properly ensure caisse inspection and promotion, Unions régionales had been requesting subsidies from the provincial government for a few years. The funding was granted on the condition that the caisses adopt centralized, representational and responsible management with whom the government could reach agreements. The Fédération de Québec was created in part to meet this need.

The members of the new cooperative organization were the 4 Unions régionales de caisses populaires created over the course of the 1920s. Its primary role was to ensure the inspection and oversight of caisses, manage an information and statistical department and authorize caisse populaire investments. The Fédération quickly became, according to historian Pierre Poulin, "a genuine coordination centre" for caisses.

The early 1940's were marked by the rapid expansion of caisses. This allowed the caisses to raise funds to create or acquire subsidiaries to be able to offer their members new services.

1944: Foundation of the first subsidiary

The first subsidiary created is Société d'assurance des caisses populaires (SACP), today Desjardins General Insurance Group. It is followed 4 years later by Assurance-vie Desjardins, now Desjardins Financial Security.

The first SACP officers (FCDQ)

The first SACP officers (FCDQ) The great period of post-war economic boom prompted the development of the consumer society. New needs emerged and the caisses were faced with the challenge of adapting to change while remaining true to their values. The 2 insurance companies expanded their operations to meet members' insurance needs and promote savings. The creation of a damage insurance company also met the needs of caisses, since it offered in a single contract all the coverage they needed against fire, hold-ups, burglaries and write-offs.

1949: Creation of Desjardins Security Fund

Following a member convention, the provincial Fédération supports the creation of a reserve to provide financial assistance to caisses that require it and maintain members' confidence in their financial institution.

Head office of the provincial Fédération in Lévis from 1945 to 1950

Head office of the provincial Fédération in Lévis from 1945 to 1950 In 1948, the Fédération organized the first convention of Unions régionales. The discussions focused on increasing their contribution to the Fédération, in part to create a reserve fund. A majority of Unions accepted the increase, and a reserve fund was quickly created. It primarily served to provide financial support to viable caisses experiencing temporary difficulties through loans with reasonable repayment terms. In addition to helping caisses get back on their feet, the intercooperative structure helped reassure members and the general public as to the financial strength of Desjardins caisses.

1950: An international convention

An international convention is organized in Lévis to celebrate the 50th anniversary of the first caisse populaire.

Guests of honour at the convention's opening night (FCDQ)

Guests of honour at the convention's opening night (FCDQ) Approximately 1,800 delegates attended from each Canadian province, the U.S., Haiti, France, Belgium, Holland and Italy. In his opening speech, Caisse populaire de Lévis President Valmore de Billy states, "You've gathered in Lévis to commemorate an anniversary, pay tribute to Alphonse Desjardins and his associates who, 50 years ago, laid down the foundation of the savings and credit cooperative movement, relive the past and pave the way for the future". 7 years later, a second international convention was organized to celebrate the 25th anniversary of the provincial Fédération.

1960: The Cité des Jardins

The development of Desjardins Group subsidiaries in Lévis takes an important turn with the construction of the Assurance-vie Desjardins head office (today Desjardins Financial Security).

The first Cité Desjardins building (FCDQ)

The first Cité Desjardins building (FCDQ) The location selected was up in the hills of Lévis. Cyrille Vaillancourt, President of Assurance-vie Desjardins and General Manager of the provincial Fédération, expressed the wish that the then-called Cité des Jardins be "a center of peace, harmony and beauty". Half a century later, the site was renamed Cité Desjardins de la coopération.

1963: A greater acceptance of consumer credit

During a convention, caisses officers decide to relax the credit policy, which members and social stakeholders had been calling for since the 1950's.

Brochure distributed to caisse officers to present the study's findings (FCDQ)

Brochure distributed to caisse officers to present the study's findings (FCDQ) The rise of consumer society led to higher levels of debt. Since the time they were founded, the caisses had a lending policy that focused on productive credit, described by historian Pierre Poulin as "that which allows one to acquire goods for professional use, pay cash for basic consumer goods, renovate a home or building, or acquire property". Following requests from members and social stakeholders, the provincial Fédération and Assurance-vie Desjardins (now Desjardins Financial Security) commissioned a wide-scale sociological study by academic professionals. The Tremblay-Fortin study looked at "the living conditions, needs and aspirations of wage-earning French-Canadian families." The study's findings prompted reflection and discussion at a caisses populaires convention on the subject, and a decision was made to relax the credit policy, primarily to slow the growth of credit companies.

1967: On the cutting edge of computer banking

At the 1967 World's Fair in Montreal, Desjardins Group uses remote data processing at Caisse populaire de l'Expo 67, a first for the financial sector in Canada.

Launch of the Système integré des caisses (SIC) pilot project at Caisse populaire de Charlesbourg on April 13,

1970 (CPDC)

Launch of the Système integré des caisses (SIC) pilot project at Caisse populaire de Charlesbourg on April 13,

1970 (CPDC) The following years were devoted to research and reflection on how to equip Desjardins Group with a computer system that all caisses could eventually link into. As of 1970, the Système intégré des caisses (SIC) was gradually implemented within the caisse network. Designed in partnership with IBM, it allowed for remote processing of all general ledger (savings and credit) transactions. The system also provided another important technological breakthrough: the Inter-caisse service, through which members could make transactions in any caisse in the network. Officially launched in 1975, Inter-caisses put Desjardins Group several years ahead of Canadian banks in terms of technology.

1970: Foundation of Développement international Desjardins

Desjardins Group establishes a company that would later be known as Développement international Desjardins (DID) to share its experience and expertise in the area of cooperative financial services with developing countries.

DID has been sharing its expertise since 1970 (DID)

DID has been sharing its expertise since 1970 (DID) To meet growing demand in the field, Desjardins Group created a subsidiary made up community finance experts. Since it was founded, DID has carried out projects in Africa, the Americas, the Caribbean, Central and Eastern Europe, and Asia.

Economic growth and a rapid increase in the number of members and assets led Desjardins Group to new heights and the need to adapt to change.

1976: Complexe Desjardins

Montreal's Complexe Desjardins is inaugurated on April 3, 1976.

Complexe Desjardins under construction (DGI)

Complexe Desjardins under construction (DGI) Work on Complexe Desjardins began in May 1972. Thanks to an idea proposed by Montreal mayor Jean Drapeau, a maple tree from Lévis was planted next to the construction site. The $200 million building project included 3 office towers with 28, 35 and 40 floors, and a hotel. Complexe Desjardins created a new pole of development in the downtown area, bridging the east and west sides of the city. The figurehead of Desjardins Group in Montreal, it evoked both its rapid growth and the know-how of Quebecers.

1979: Foundation of Caisse centrale Desjardins

Caisse centrale Desjardins (CCD) is founded in September 1979.

The original Caisse centrale Desjardins logo (FCDQ)

The original Caisse centrale Desjardins logo (FCDQ) The idea for a central caisse went back to the era of Alphonse Desjardins. At the official launch of CCD, Desjardins Group president Raymond Blais stated that it was "a significant moment in the history of our Group". He added that thanks to CCD, "local caisses would become part of a powerful and dynamic financial group, allowing them to have greater involvement in the community". In addition to managing Union régionale liquidity and cash, CCD became Desjardins Group's financial agent on Canadian and international markets. CCE represented Desjardins Group within the Canadian Payments Association (now Payments Canada), which is responsible for clearing and settling payments between financial institutions. On January 1, 2017, CCD merged with Fédération des caisses Desjardins du Québec.

1979: New affiliations

In November, 1979, Fédération des caisses d'économie du Québec becomes affiliated with Fédération de Québec des caisses populaires, marking the beginning of the consolidation of the savings and credit caisse network.

General manager of Fédération des caisses d'économie Robert Soupras, and Desjardins Group president Alfred Rouleau, at the signing

the memorandum of understanding in 1979 (Réjean DeRoy, FCDQ)

General manager of Fédération des caisses d'économie Robert Soupras, and Desjardins Group president Alfred Rouleau, at the signing

the memorandum of understanding in 1979 (Réjean DeRoy, FCDQ) With the arrival of Fédération des caisses d'économie in Desjardins Group, Fédération de Québec change its name to Confédération des caisses populaires et d'économie Desjardins du Québec and the 10 Unions régionales became regional federations. Consolidation of the savings and credit caisse network would continue in subsequent years.

Fédération de Montréal des caisses Desjardins, which had left Desjardins Group in 1945, was reinstated in 1982. As for the Francophone federations of Caisses populaires de l'Ontario (1989), Caisses populaires du Manitoba (1989) and Caisses populaires de l'Acadie (1990), they were admitted as auxiliary members, which gave them access to the same services as regular members but no voting rights or eligibility to administrative functions. In 2003, caisses in the Fédération des caisses populaires de l'Ontario became regular members of Fédération des caisses Desjardins.

1981: Plastic money

In August, the Visa franchise is purchased by Desjardins Group. In October of the same year, an ATM implementation pilot project is carried out in the Trois-Rivières region.

One of the first ATMs (FCDQ)

One of the first ATMs (FCDQ) After much debate about credit cards during the previous decade, Desjardins Group decided to offer the payment method to meet the demands and needs of members. As for ATMs, they improved accessibility to the caisses and rapidly become popular. The idea of using machines to collect savings is older than it seems–it had been tested in Italy in the late 19th century, and had attracted the interest of Alphonse Desjardins.

1986: An office in Toronto

On May 15, 1986, the Toronto office of Caisse centrale Desjardins opens with great fanfare.

Ad published in The Globe and Mail on May 20, 1986

Ad published in The Globe and Mail on May 20, 1986 A major press conference was held, attended by many members of the English-language media. The next day, the Toronto Star, the largest circulation daily in Canada, printed the following: "The opening of a Toronto office is seen by the Caisse centrale as the first step in its goal penetrating the Canadian business market and diversifying its deposit and loan portfolio". 6 years later, Desjardins Group crossed the border into the U.S., with Desjardins Federal Savings Bank, now Desjardins Bank, in Hallandale, Florida, to serve members who winter in the Sunshine State.

1987: Direct insurance

In fall 1987, Desjardins General Insurance Group (DGIG) shifted to direct insurance.

Press conference to announce the launch of direct insurance in 1987 (FCDQ)

Press conference to announce the launch of direct insurance in 1987 (FCDQ) Previously relying on brokers, DGIG shifted to selling P&C insurance in caisses and over the phone. After a year, the head of DGIG announced that without mass advertising, premium volume had reached $50 million, equivalent to 142,000 insurance policies. Selling directly to clients cost less, meaning DGIG could pass on the savings and offer premiums that were 10–15% lower than traditional insurance companies that used brokers exclusively.

1988: Entry into the securities market

Desjardins Group makes its entry into the securities market with the acquisition of discount brokerage firm Disnat and the creation of Corporation Desjardins des valeurs mobilières (CDVM).

Desjardins, Deragon, Langlois offices in 1991 (Pierre Brault, FCDQ)

Desjardins, Deragon, Langlois offices in 1991 (Pierre Brault, FCDQ) One year later, CDVM became the majority shareholder of full-service broker Deragon, Langlois, which was renamed Desjardins, Deragon, Langlois. It completed the purchase of Disnat in 1990, and Desjardins, Deragon, Langlois in 1991. The Corporation thus became a full service brokerage firm with a discount brokerage arm, Disnat, with the new name Desjardins Securities.

1996: Launch of Desjardins.com

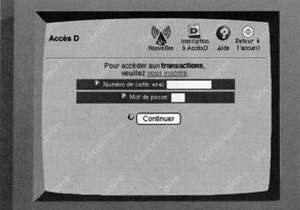

The Desjardins Group website is launched in September 1996.

Transactions go online (FCDQ)

Transactions go online (FCDQ) Originally a strictly informational site, it was followed, on December 17, 1996, with AccèsD Internet, the first financial transactional site in Quebec. The site went from 4,280 registered members in 1997, to millions of visitors per month in 2006. Constantly adapting to members' needs, Desjardins Group's online service offers expanded again in 2010 with the development of mobile services for members with smartphones and tablets.

1997: Pooling resources

Caisses on Montreal's south shore successfully experiment with pooling their financial resources to better meet the needs of entrepreneurs. The Desjardins business centre is created.

A Desjardins business centre (G. DesRosiers, FCDQ)

A Desjardins business centre (G. DesRosiers, FCDQ) The following year, a dozen Desjardins Business Centres were opened. Desjardins Group saw its commercial and industrial credit market share grow in proportion to the rapid increase in these caisse alliances. In January 2000, only 3 years after the pilot project, the network had 55 Desjardins Business Centres in operation or underway. The model that became widespread helped companies in various sectors of activity through all phases of business development. In 1997, the same principle of intercooperation led to the creation of a first administrative centre in Outaouais, to centralize back office operations for several caisses. The model spread, as in the case of Desjardins business centres.

In recent years, Desjardins Group has set up new structures and worked on expanding its operations outside of Quebec in other Canadian provinces.

2000: Acquisition of The Personal

In June, Desjardins General Insurance Group (DGIG) makes a major acquisition.

The Personal logo

The Personal logo DGIG ratified an agreement for the acquisition of 2 CIBC insurance subsidiaries: The Personal and CIBC's General Insurance Company. The transaction, evaluated at $330 million, allowed Desjardins Group to break into the Canadian market. A group insurer, The Personal operates in all Canadian provinces. The General Insurance Company, a personal insurer, had, at the time, clients primarily in Ontario and Alberta.

2001: A single Fédération begins its operations

On July 1, 2001, the new Fédération des caisses Desjardins du Québec begins its operations.

Participants of the 17th convention of 1999 discuss proposed changes. (G. DesRosiers, FCDQ)

Participants of the 17th convention of 1999 discuss proposed changes. (G. DesRosiers, FCDQ) A desire to reduce Desjardins Group operating costs and strengthen its unity in action became the centre of focus as of 1996. This led to the establishment of a single Fédération in 2001 and a move from a 3-tiered structure (caisses populaires, federations and the Confédération) to a 2-tiered structure (caisses populaires and the Fédération). The new Fédération came as a result of the merger of the 10 regional caisse federations, the Fédération des caisses d'économie and the Confédération, and now served the entire caisse network. Desjardins Group was now organized in more agile fashion and better able to meet future challenges. The transition, which has been planned to take place over a 3- to 5-year span, took only 1 and one half years.

2004: Desjardins Group single management structure

On May 12, 2004, important changes are made to the organization of Desjardins Group, including the creation of 6 major strategic functions.

The Fédération head office in Lévis (Ghislain DesRosiers, FCDQ)

The Fédération head office in Lévis (Ghislain DesRosiers, FCDQ) This was an important move towards reinforcing a single management structure and consolidating Desjardins Group strategic management. 6 major functions are created: financial management, integrated risk management, cash management, human resources management, strategic planning, Canadian business development, and institutional affairs.

2011: A symbol of growth

On August 15, 2011, work begins on a new building in Cité Desjardins de la cooperation in Lévis.

150 rue des Commandeurs and Place de la Coopération (G. Desrosiers, FCDQ)

150 rue des Commandeurs and Place de la Coopération (G. Desrosiers, FCDQ) The new 15-story, 380,000-square-foot building represented a major investment for Lévis. The building included 1,500 new workspaces to bring together employees previously scattered across different worksites in the area. Included were a fitness centre and modular meeting rooms accommodating up to 400 people. The building was inaugurated on December 11, 2014, followed by Place de la Coopération in the summer of 2015. The building is home to the world's tallest interior living wall and has earned LEED®-NC Gold certification.

2012: International Summit of Cooperatives

Desjardins co-hosts the first International Summit of Cooperatives.

A panel during the 2012 International Summit of Cooperatives (C. Côté, FCDQ)

A panel during the 2012 International Summit of Cooperatives (C. Côté, FCDQ) As part of the UN-decreed International Year of Cooperatives, the first International Summit of Cooperatives was held in Quebec City and Lévis in October 2012. The theme for the summit was “The Amazing Power of Cooperatives.” Desjardins Group co-hosted the summit alongside the International Co-operative Alliance and Saint Mary's University. A declaration from the summit was submitted to the UN. The second and third editions of the summit were held in Quebec City in October 2014 and 2016 under the respective themes of “Cooperatives' Power to Innovate” and “Cooperatives: The Power to Act.” An average of 3,000 people—from 90 countries—attended each summit.

2015: Acquisition of State Farm

Desjardins Group acquires State Farm's Canadian operations.

The State Farm head office in Aurora, near Toronto (FCDQ)

The State Farm head office in Aurora, near Toronto (FCDQ) In January 2014, Desjardins Group announced that it had reached an agreement to acquire the Canadian operations of State Farm, the largest property and casualty (P&C) mutual insurance company in the United States. State Farm's P&C and life insurance operations, as well as its mutual fund, loan and health insurance companies, were transferred to Desjardins Group on January 1, 2015. State Farm and French cooperative Crédit Mutuel made investments in Desjardins Group's P&C insurer as part of the deal, which led to Desjardins Group's P&C insurer becoming the second largest in Canada.

2018: A logo for the digital age

In March 2018, Desjardins changed its logo.

New logo launched in 2018

New logo launched in 2018 The logo was simplified to make it easier to recognize on mobile devices. The streamlined logo kept the main features of the 1977 version: the hexagon and the iconic shade of green. This update was the biggest change to the logo since its creation some 40 years earlier.

2018: A single credit union in Ontario

In November 2018, the members of 11 Desjardins-affiliated caisses populaires in Ontario voted in favour of a merger.

During special general meetings, they approved the merging plan to form a single institution: Caisse Desjardins Ontario Credit Union Inc. Officially established on January 1, 2020, it has 130,000 members, 50 branches, 1 Desjardins Business centre, 1 Desjardins Signature Service office, 650 employees and nearly $14 billion in assets under management.

2020: Together for 120 years

2020 is a big year for anniversaries at Desjardins Group.

The first caisse in Lévis, where Desjardins’s story began, is celebrating 120 years and it’s been a century since founder Alphonse Desjardins passed away. This year also marks 75 years in the P&C insurance industry, while Développement international Desjardins, the Desjardins Foundation and our Co-op Week all turn 50.